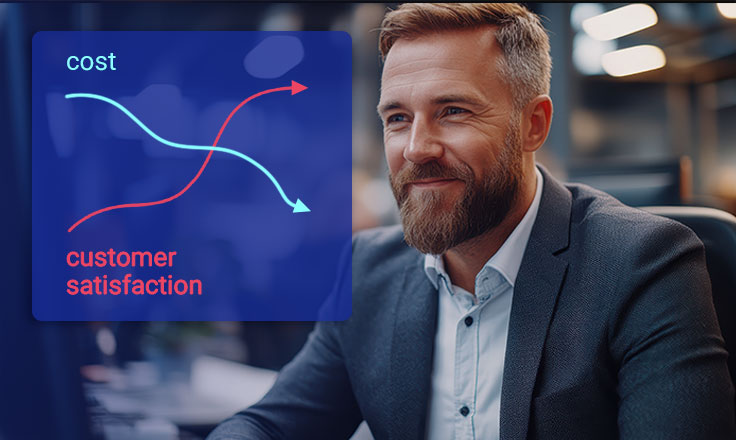

Two ways of reducing the claims handling costs

Optimizing claims handling costs is a key topic in general discussions within the insurance industry. We can look at this global problem from two distinct perspectives.

1. Improving repeatable processes

The first one is about improving simple but repeatable processes, where the main challenge is the large number of claims, such as in health or car insurance. In these cases, it’s essential to automate the process to handle a big volume quickly and efficiently.

2. Improving complex processes

The second one is related to more complex claims, as in life insurance. Here, the number of claims is smaller, but the process is more complicated. It’s important to automate the whole path of the claim – from the first notification (FNOL), through client portals, collecting and verifying documents, assessing if the claim is valid, to checking it against specific policy terms and conditions. These cases often involve several people over time, so having a smooth and well-automated process genuinely helps.

Possible cost savings improvements – the checklist

Below is a list of improvements that can serve as a checklist or potential tasks to add to the backlog. Each task provides an opportunity for real improvement. We base it on experience from implemented projects with our European and international clients. The 30% figure is a realistic potential for improvement. It may be slightly lower or significantly higher, depending on the scale of the current challenges and the available resources, such as budget or employment. However, the effects of the change will be undoubtedly visible.

- By implementing an innovative front office, system availability is increased, transparency is enhanced, and data access is accelerated – reducing the risk of errors.

- With configurable permissions and user roles, changes can be made quickly and intuitively.

- Automating the complaint handling process enables automatic reporting, verification, auto-completion, and prioritization of claims.

- Shortening the duration of comprehensive customer service allows for faster payments, potentially even on the same day.

- Automating the payment process, including integration with internal accounting and banking systems, significantly reduces the time between claim approval and payout – enabling near real-time payments.

- Centralizing complaint handling and customer documentation within a single system (instead of email) ensures secure, controlled access for authorized users.

- Consolidating data, documents, and processes into one system significantly saves time by streamlining verification, information processing, decision-making, and implementation.

- Storing documents in a DMS (Document Management System) reduces the need to print and manually process emails and attachments.

- Well-designed document templates improve clarity, minimizing the number of customer complaints.

- The business parameterizer enables faster implementation of product versions, actuarial updates, print templates, and even financial and accounting module changes – enhancing system configurability.

- Navigation widgets support KPI management by allowing the configuration of claims administration metrics and providing personalized statistics and progress tracking for each operator.

- System simulation of profitability – based on policy and claims data – supports the daily operations of the controlling team.

- Integration between the claims registration system and related systems (policy administration, accounting, and DMS) reduces the overall time needed for claims registration.

Barriers in the insurance process automation

In every Insurance Transformation project, barriers must appear: implementation costs, return on investment (ROI), organizational resistance, etc. However, not everything has to be done at once.

The issue of high implementation costs can be solved by dividing the project into phases. A phased approach enables the start with areas that yield the greatest benefits and gradually expand improvements throughout the organization. By focusing first on selected processes with the greatest potential for reducing insurance costs or improving efficiency, the organization can achieve quick wins and justify further investment. ROI can be accelerated by delivering the first working solutions within a few months. Organizational resistance can be overcome, for example, by clear and engaging communication. We have successfully guided clients through this kind of transformation, step by step. With the right strategy, it's both achievable and sustainable.

Cost optimization through insurance transformation

Embracing claims process transformation means more than just cost savings. By intelligent automation, system integration, and data centralization, claims handling can be transformed into a strategic asset rather than a cost center for insurers.

Claims transformation means faster settlements, fewer errors, greater transparency, and more empowered employees, which translates to quicker responses and more seamless customer experiences. All of this builds trust and long-term loyalty, benefiting both customers and insurance companies.

Achieving success requires more than technology, however. It demands a phased, strategic approach that addresses internal resistance, manages change effectively, and prioritizes high-impact improvements. Setting clear objectives and employing adaptable systems not only reduces operational expenses but also strengthens a position in an increasingly digital and customer-driven insurance industry market.

Insurers who invest in claims automation today are not just optimizing processes—they are future-proofing their businesses.

Authors: Sylwia Frątczak (Product Marketing Manager) & Piotr Konieczny (IT Project Manager for Insurance Services)